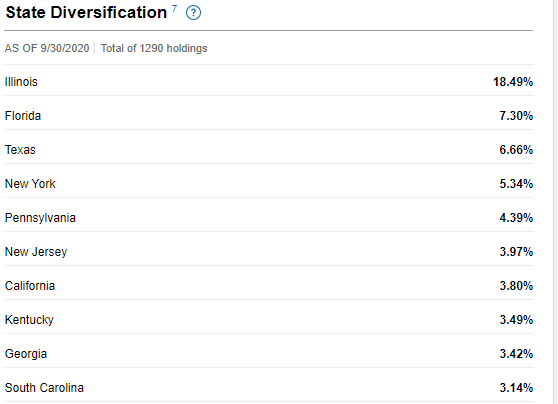

fidelity tax-free bond fund by state 2019

The income from such bonds is generally free from. MainStay MacKay Tax Free Bond Fund Class A-1054-044.

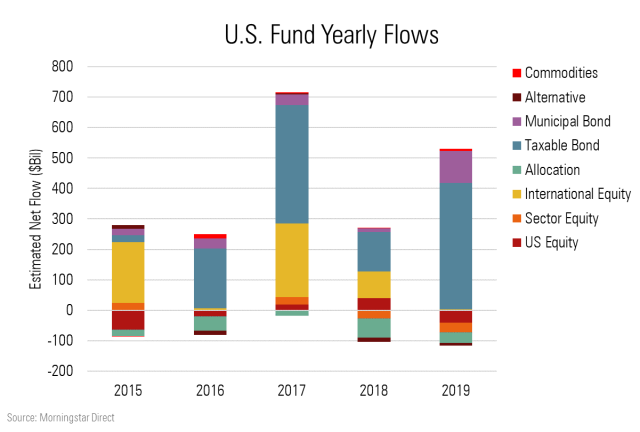

Where Did Fund Investors Put Their Money In July Morningstar

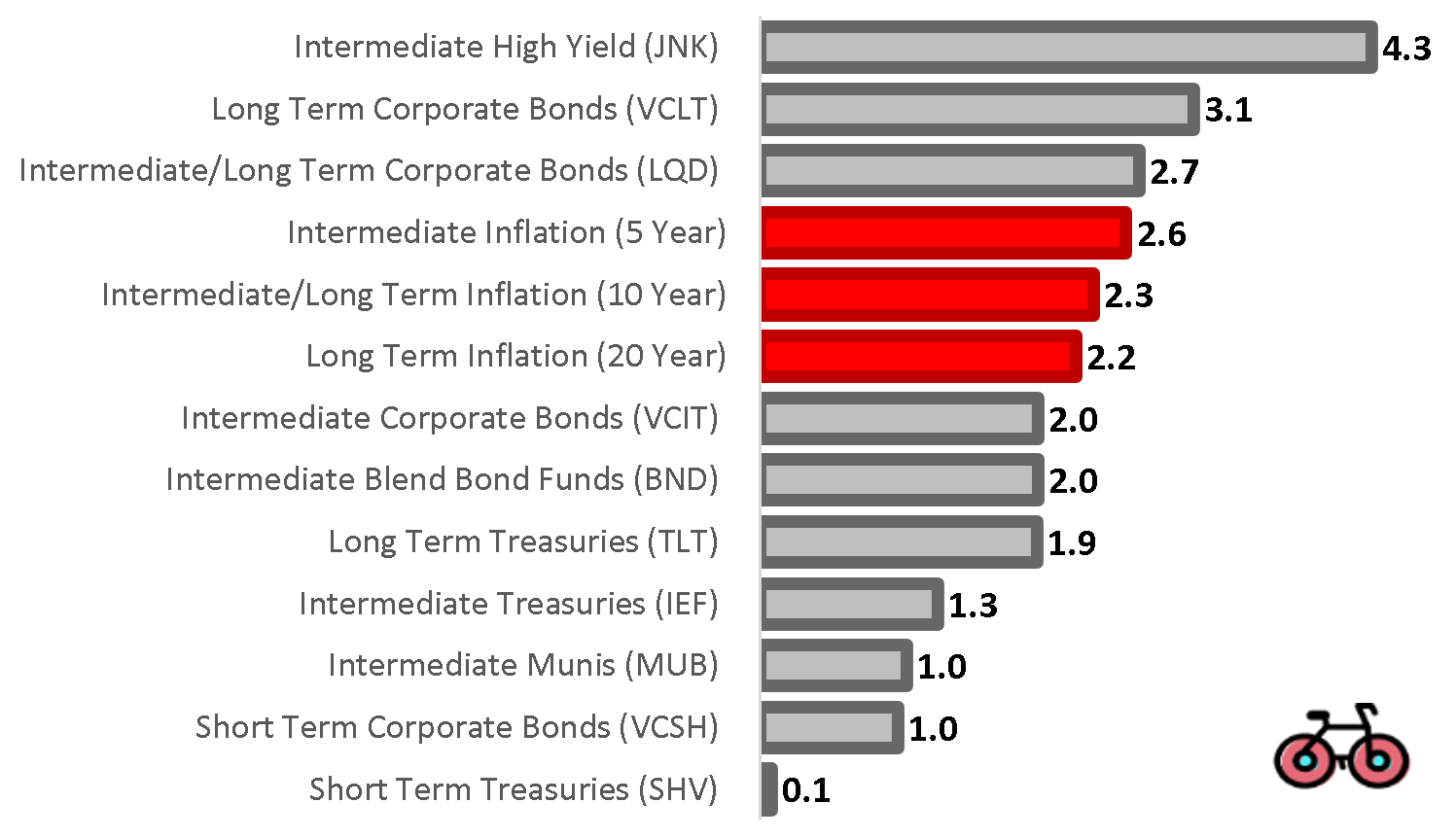

For state-specific funds TEYs are calculated by first dividing i that portion of a funds yield that is tax-exempt reduced for the potential effect of state income tax on the.

. Municipal buy tax-free bonds from local and state governments. Fidelity Tax-Free Bond Fund Gross Expense Ratio. It potentially invests more than.

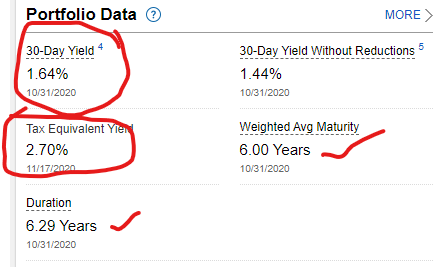

Fidelity Tax-Free Bond Fund FTABX. Stay up to date with the current NAV star rating asset. Issue Coupon Maturity Date Amount Owned of Fund.

AJ Bell Favourite funds Funds can make investing easier. MainStay MacKay Tax Free Bond Fund Class A Load Adjusted-1456-196. Learn How Our Equities Can Help Your Clients Pursue Their Investment Goals.

Fidelity Inflation-Protected Bond Index Fund With a four-star quantitative rating from Morningstar FIPDX is a fixed-income fund that ties about 80 of holdings to the. Gain access and insights to the muni market with Invesco funds. Gain access and insights to the muni market with Invesco funds.

Fidelity Tax-Free Bond FTABX FTABX holds municipal bonds that are exempt from federal income tax. Information provided in this document is for informational and educational purposes only. Click here for Fidelity Advisor mutual fund information.

Most of the holdings are bonds issued by state and city governments. Ad With negative real bond yields here is how you can invest for passive income right now. The fund normally invests at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax.

This company is required by law to distribute 90 of its taxable income to shareholders. Muni single-state short portfolios invest in bonds issued by state and local governments to fund public projects. Top Five States as of July 31 2021 of funds net assets Illinois 167 Florida 69 New York 68 Texas 60 New Jersey 56 Top Five Sectors as of July 31 2021 of funds net assets General.

Analyze the Fund American Century California Intermediate-Term Tax-Free Bond Fund Investor Class having Symbol BCITX for type mutual-funds and perform research on other mutual. All Classes Fidelity Limited Term Municipal Income. 0462-657 -657 -416 193 298 331 Bloomberg 3 Year Non-AMT Municipal Bond Index-677 -677 -482 164 272.

Eaton Vance National Municipal Income Fund Class A EANAX Fidelity Tax-Free Bond Fund FTABX T. Ad Research a Variety of Municipal Bond Funds Available from Fidelity. The amount of municipal bond interest from your state Puerto Rico the Virgin Islands and Guam can be calculated by multiplying the total interest dividend you received from a fund reported.

XNAS quote with Morningstars data and independent analysis. 300000 in a tax. To the extent any investment information in this material is deemed to be a recommendation it is not.

Rowe Price Summit Municipal Income Fund Investor Class PRINX. Ad Discover a wide variety of municipal market investing opportunities. Learn About The Tax-Exempt Bond Fund of America.

Ad Equities Backed By The Capital Systems Ongoing Rigorous Investment Analysis. Rowe Price Summit Municipal Income Fund Investor Class PRINX. FTABX FTABX invests primarily in investment-grade municipal securities with interest exempt from federal tax.

Ad Become a Smarter Invester with Best-in-Class Trading Platforms Education and More. That means a 100000. The fund has returned -781 percent over the past year 049 percent over the past three years 202 percent over the past five years and 285 percent over the past decade.

See letters from prior years 2014-2020. Even with interest rates on savings accounts and certificates of deposit crawling up in the wake of the Federal Reserves interest rate hikes the 962 composite rate on newly. Ad Discover a wide variety of municipal market investing opportunities.

Eaton Vance National Municipal Income Fund Class A EANAX Fidelity Tax-Free Bond Fund FTABX T. For a household earning 200000 per year married filing jointly taxed at 24 a municipal bond yielding 4 has a tax-equivalent yield of 526. Exempt interest dividend income earned by your fund during 2021.

State Fidelity Investments Money Market Tax Exempt Portfolio. Find the latest Fidelity Tax-Free Bond FTABX. California Statewide Cmntys De Rev Bd 5.

Fidelity calculates and reports the portion of tax-exempt interest dividend.

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

Nad Provides Investors Safer Cef For Municipal Bond Exposure Nyse Nad Seeking Alpha

The Best Taxable Bond Funds M Mutual Fund Observer Discussions

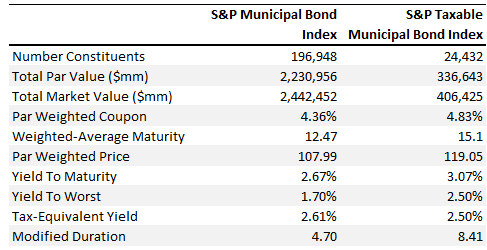

The Role Of Taxable Municipal Bonds In Investor Portfolios Seeking Alpha

U S Fund Flows Set A New Record In The First Half Of 2021 Morningstar

Are Tax Free Muni Bonds Right For Your Portfolio What To Know

Where Did Fund Investors Put Their Money In July Morningstar

Cfbax Climate Focused Bond Fund Class A Lord Abbett

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

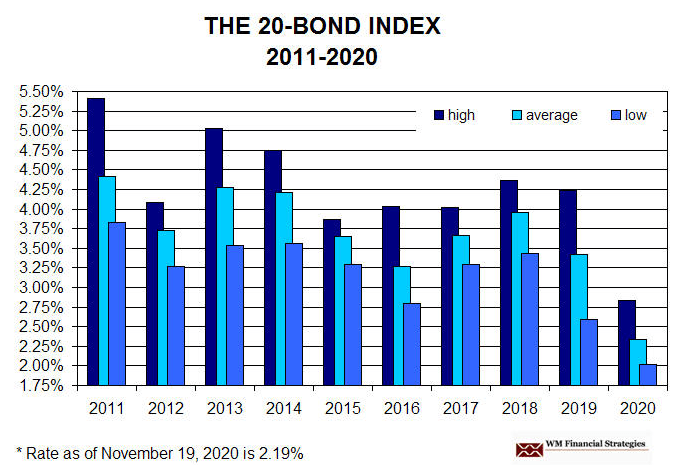

Market Watch 2021 The Bond Market Fidelity

U S Fund Flows Set A New Record In The First Half Of 2021 Morningstar

U S Fund Flows Set A New Record In The First Half Of 2021 Morningstar

Best Municipal Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

How To Choose The Best Us Bond Etf

Retirement Bucket Approach Cash Flow Management Fidelity Cash Flow Saving Goals Retirement